Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales Page 1 of 1

安信证券

ESSENCE SECURITIES

各项声明请参见报告尾页。

ESSENCE SECURITIES

公司快报/兔宝宝

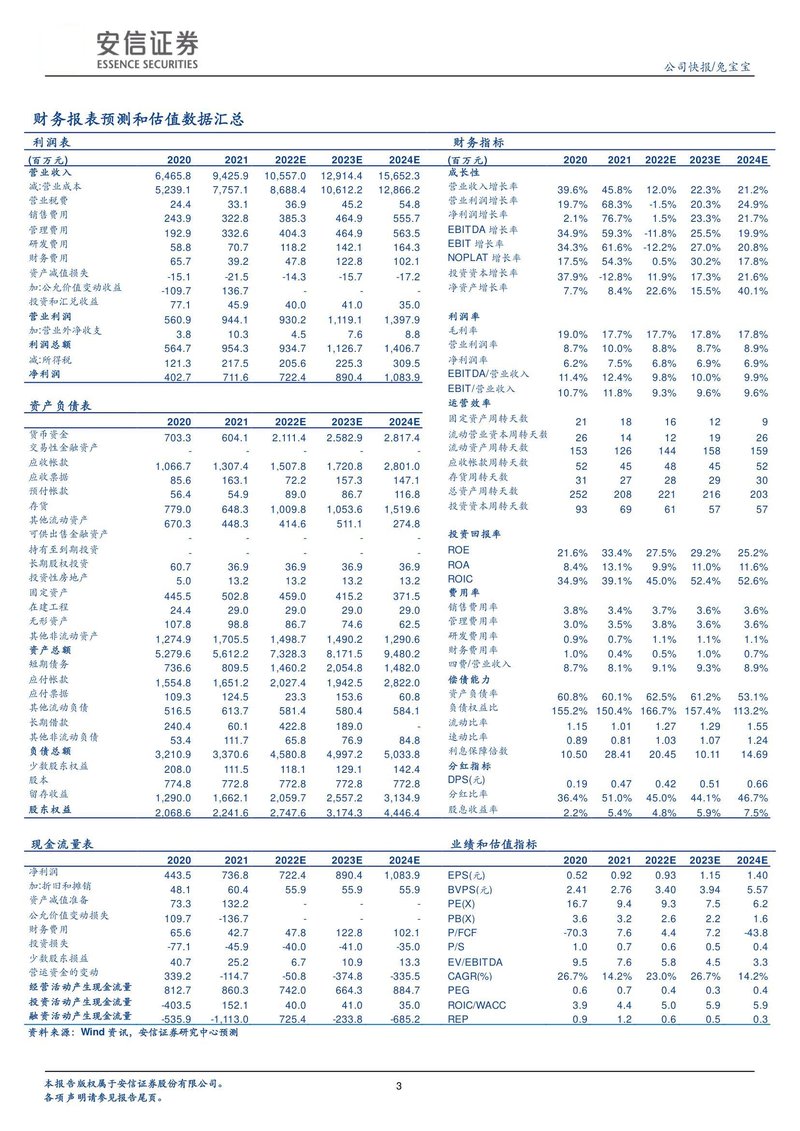

财务报表预测和估值数据汇总

利润表

| (百万元) | 2020 | 2021 | 2022E | 2023E | 2024E |

|---|---|---|---|---|---|

| 营业收入 | 6,465.8 | 9,425.9 | 10,557.0 | 12,914.4 | 15,652.3 |

| 减:营业成本 | 5,239.1 | 7,757.1 | 8,688.4 | 10,612.2 | 12,866.2 |

| 营业税费 | 24.4 | 33.1 | 36.9 | 45.2 | 54.8 |

| 销售费用 | 243.9 | 322.8 | 385.3 | 464.9 | 555.7 |

| 管理费用 | 192.9 | 332.6 | 404.3 | 464.9 | 563.5 |

| 研发费用 | 58.8 | 70.7 | 118.2 | 142.1 | 164.3 |

| 财务费用 | 65.7 | 39.2 | 47.8 | 122.8 | 102.1 |

| 资产减值损失 | -15.1 | -21.5 | -14.3 | -15.7 | -17.2 |

| 加:公允价值变动收益 | -109.7 | 136.7 | - | - | - |

| 投资和汇兑收益 | 77.1 | 45.9 | 40.0 | 41.0 | 35.0 |

| 营业利润 | 560.9 | 944.1 | 930.2 | 1,119.1 | 1,397.9 |

| 加:营业外净收支 | 3.8 | 10.3 | 4.5 | 7.6 | 8.8 |

| 利润总额 | 564.7 | 954.3 | 934.7 | 1,126.7 | 1,406.7 |

| 减:所得税 | 121.3 | 217.5 | 205.6 | 225.3 | 309.5 |

| 净利润 | 402.7 | 711.6 | 722.4 | 890.4 | 1,083.9 |

资产负债表

| 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|

| 货币资金 | 703.3 | 604.1 | 2,111.4 | 2,582.9 | 2,817.4 |

| 交易性金融资产 | - | - | - | - | - |

| 应收帐款 | 1,066.7 | 1,307.4 | 1,507.8 | 1,720.8 | 2,801.0 |

| 应收票据 | 85.6 | 163.1 | 72.2 | 157.3 | 147.1 |

| 预付帐款 | 56.4 | 54.9 | 89.0 | 86.7 | 116.8 |

| 存货 | 779.0 | 648.3 | 1,009.8 | 1,053.6 | 1,519.6 |

| 其他流动资产 | 670.3 | 448.3 | 414.6 | 511.1 | 274.8 |

| 可供出售金融资产 | - | - | - | - | - |

| 持有至到期投资 | - | - | - | - | - |

| 长期股权投资 | 60.7 | 36.9 | 36.9 | 36.9 | 36.9 |

| 投资性房地产 | 5.0 | 13.2 | 13.2 | 13.2 | 13.2 |

| 固定资产 | 445.5 | 502.8 | 459.0 | 415.2 | 371.5 |

| 在建工程 | 24.4 | 29.0 | 29.0 | 29.0 | 29.0 |

| 无形资产 | 107.8 | 98.8 | 86.7 | 74.6 | 62.5 |

| 其他非流动资产 | 1,274.9 | 1,705.5 | 1,498.7 | 1,490.2 | 1,290.6 |

| 资产总额 | 5,279.6 | 5,612.2 | 7,328.3 | 8,171.5 | 9,480.2 |

| 短期债务 | 736.6 | 809.5 | 1,460.2 | 2,054.8 | 1,482.0 |

| 应付帐款 | 1,554.8 | 1,651.2 | 2,027.4 | 1,942.5 | 2,822.0 |

| 应付票据 | 109.3 | 124.5 | 23.3 | 153.6 | 60.8 |

| 其他流动负债 | 516.5 | 613.7 | 581.4 | 580.4 | 584.1 |

| 长期借款 | 240.4 | 60.1 | 422.8 | 189.0 | - |

| 其他非流动负债 | 53.4 | 111.7 | 65.8 | 76.9 | 84.8 |

| 负债总额 | 3,210.9 | 3,370.6 | 4,580.8 | 4,997.2 | 5,033.8 |

| 少数股东权益 | 208.0 | 111.5 | 118.1 | 129.1 | 142.4 |

| 股本 | 774.8 | 772.8 | 772.8 | 772.8 | 772.8 |

| 留存收益 | 1,290.0 | 1,662.1 | 2,059.7 | 2,557.2 | 3,134.9 |

| 股东权益 | 2,068.6 | 2,241.6 | 2,747.6 | 3,174.3 | 4,446.4 |

现金流量表

| 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|

| 净利润 | 443.5 | 736.8 | 722.4 | 890.4 | 1,083.9 |

| 加:折旧和摊销 | 48.1 | 60.4 | 55.9 | 55.9 | 55.9 |

| 资产减值准备 | 73.3 | 132.2 | - | - | - |

| 公允价值变动损失 | 109.7 | -136.7 | - | - | - |

| 财务费用 | 65.6 | 42.7 | 47.8 | 122.8 | 102.1 |

| 投资损失 | -77.1 | -45.9 | -40.0 | -41.0 | -35.0 |

| 少数股东损益 | 40.7 | 25.2 | 6.7 | 10.9 | 13.3 |

| 营运资金的变动 | 339.2 | -114.7 | -50.8 | -374.8 | -335.5 |

| 经营活动产生现金流量 | 812.7 | 860.3 | 742.0 | 664.3 | 884.7 |

| 投资活动产生现金流量 | -403.5 | 152.1 | 40.0 | 41.0 | 35.0 |

| 融资活动产生现金流量 | -535.9 | -1,113.0 | 725.4 | -233.8 | -685.2 |

财务指标

| (百万元) | 2020 | 2021 | 2022E | 2023E | 2024E |

|---|---|---|---|---|---|

| 成长性 | |||||

| 营业收入增长率 | 39.6% | 45.8% | 12.0% | 22.3% | 21.2% |

| 营业利润增长率 | 19.7% | 68.3% | -1.5% | 20.3% | 24.9% |

| 净利润增长率 | 2.1% | 76.7% | 1.5% | 23.3% | 21.7% |

| EBITDA 增长率 | 34.9% | 59.3% | -11.8% | 25.5% | 19.9% |

| EBIT 增长率 | 34.3% | 61.6% | -12.2% | 27.0% | 20.8% |

| NOPLAT 增长率 | 17.5% | 54.3% | 0.5% | 30.2% | 17.8% |

| 投资资本增长率 | 37.9% | -12.8% | 11.9% | 17.3% | 21.6% |

| 净资产增长率 | 7.7% | 8.4% | 22.6% | 15.5% | 40.1% |

| 利润率 | |||||

| 毛利率 | 19.0% | 17.7% | 17.7% | 17.8% | 17.8% |

| 营业利润率 | 8.7% | 10.0% | 8.8% | 8.7% | 8.9% |

| 净利润率 | 6.2% | 7.5% | 6.8% | 6.9% | 6.9% |

| EBITDA/营业收入 | 11.4% | 12.4% | 9.8% | 10.0% | 9.9% |

| EBIT/营业收入 | 10.7% | 11.8% | 9.3% | 9.6% | 9.6% |

| 运营效率 | |||||

| 固定资产周转天数 | 21 | 18 | 16 | 12 | 9 |

| 流动营业资本周转天数 | 26 | 14 | 12 | 19 | 26 |

| 流动资产周转天数 | 153 | 126 | 144 | 158 | 159 |

| 应收账款周转天数 | 52 | 45 | 48 | 45 | 52 |

| 存货周转天数 | 31 | 27 | 28 | 29 | 30 |

| 总资产周转天数 | 252 | 208 | 221 | 216 | 203 |

| 投资资本周转天数 | 93 | 69 | 61 | 57 | 57 |

| 投资回报率 | |||||

| ROE | 21.6% | 33.4% | 27.5% | 29.2% | 25.2% |

| ROA | 8.4% | 13.1% | 9.9% | 11.0% | 11.6% |

| ROIC | 34.9% | 39.1% | 45.0% | 52.4% | 52.6% |

| 费用率 | |||||

| 销售费用率 | 3.8% | 3.4% | 3.7% | 3.6% | 3.6% |

| 管理费用率 | 3.0% | 3.5% | 3.8% | 3.6% | 3.6% |

| 研发费用率 | 0.9% | 0.7% | 1.1% | 1.1% | 1.1% |

| 财务费用率 | 1.0% | 0.4% | 0.5% | 1.0% | 0.7% |

| 四费/营业收入 | 8.7% | 8.1% | 9.1% | 9.3% | 8.9% |

| 偿债能力 | |||||

| 资产负债率 | 60.8% | 60.1% | 62.5% | 61.2% | 53.1% |

| 负债权益比 | 155.2% | 150.4% | 166.7% | 157.4% | 113.2% |

| 流动比率 | 1.15 | 1.01 | 1.27 | 1.29 | 1.55 |

| 速动比率 | 0.89 | 0.81 | 1.03 | 1.07 | 1.24 |

| 利息保障倍数 | 10.50 | 28.41 | 20.45 | 10.11 | 14.69 |

| 分红指标 | |||||

| DPS(元) | 0.19 | 0.47 | 0.42 | 0.51 | 0.66 |

| 分红比率 | 36.4% | 51.0% | 45.0% | 44.1% | 46.7% |

| 股息收益率 | 2.2% | 5.4% | 4.8% | 5.9% | 7.5% |

业绩和估值指标

| 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|

| EPS(元) | 0.52 | 0.92 | 0.93 | 1.15 | 1.40 |

| BVPS(元) | 2.41 | 2.76 | 3.40 | 3.94 | 5.57 |

| PE(X) | 16.7 | 9.4 | 9.3 | 7.5 | 6.2 |

| PB(X) | 3.6 | 3.2 | 2.6 | 2.2 | 1.6 |

| P/FCF | -70.3 | 7.6 | 4.4 | 7.2 | -43.8 |

| P/S | 1.0 | 0.7 | 0.6 | 0.5 | 0.4 |

| EV/EBITDA | 9.5 | 7.6 | 5.8 | 4.5 | 3.3 |

| CAGR(%) | 26.7% | 14.2% | 23.0% | 26.7% | 14.2% |

| PEG | 0.6 | 0.7 | 0.4 | 0.3 | 0.4 |

| ROIC/WACC | 3.9 | 4.4 | 5.0 | 5.9 | 5.9 |

| REP | 0.9 | 1.2 | 0.6 | 0.5 | 0.3 |

资料来源: Wind 资讯, 安信证券研究中心预测

本报告版权属于安信证券股份有限公司。各项声明请参见报告尾页。

3