Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales Page 1 of 1

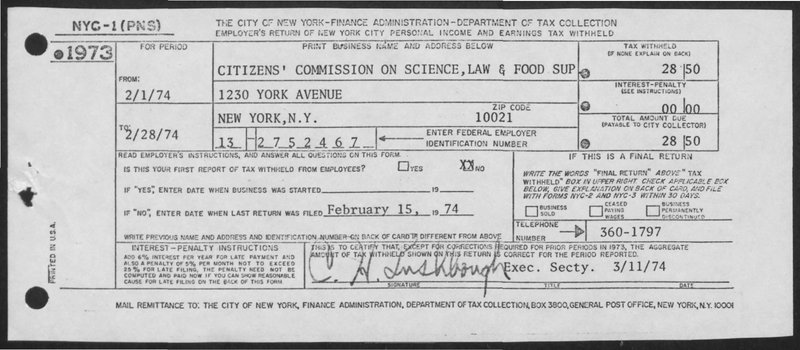

NYC-1 (PNS)

THE CITY OF NEW YORK-FINANCE ADMINISTRATION-DEPARTMENT OF TAX COLLECTION

EMPLOYER'S RETURN OF NEW YORK CITY PERSONAL INCOME AND EARNINGS TAX WITHHELD

•1973

| FOR PERIOD | PRINT BUSINESS NAME AND ADDRESS BELOW |

TAX WITHHELD

(IF NONE EXPLAIN ON BACK) |

|

|

FROM:

2/1/74 |

CITIZENS' COMMISSION ON SCIENCE, LAW & FOOD SUP | 28 50 | |

|

TO:

2/28/74 |

1230 YORK AVENUE |

ZIP CODE

10021 |

INTEREST-PENALTY

(SEE INSTRUCTIONS) 00 00 |

|

NEW YORK, N.Y.

13 2752467 |

ENTER FEDERAL EMPLOYER

IDENTIFICATION NUMBER |

TOTAL AMOUNT DUE

(PAYABLE TO CITY COLLECTOR) 28 50 |

|

| READ EMPLOYER'S INSTRUCTIONS, AND ANSWER ALL QUESTIONS ON THIS FORM. | |||

| IS THIS YOUR FIRST REPORT OF TAX WITHHELD FROM EMPLOYEES? | YES | NO | |

| IF "YES", ENTER DATE WHEN BUSINESS WAS STARTED. | 19 | ||

| IF "NO", ENTER DATE WHEN LAST RETURN WAS FILED. | February 15, 19 74 | ||

| WRITE PREVIOUS NAME AND ADDRESS AND IDENTIFICATION NUMBER ON BACK OF CARD IF DIFFERENT FROM ABOVE | IF THIS IS A FINAL RETURN | ||

|

INTEREST-PENALTY INSTRUCTIONS

ADD 6% INTEREST PER YEAR FOR LATE PAYMENT AND ALSO A PENALTY OF 5% PER MONTH NOT TO EXCEED 25% FOR LATE FILING, THE PENALTY NEED NOT BE COMPUTED AND PAID NOW IF YOU CAN SHOW REASONABLE CAUSE FOR LATE FILING ON THE BACK OF THIS FORM. |

WRITE THE WORDS "FINAL RETURN" ABOVE "TAX WITHHELD" BOX IN UPPER RIGHT. CHECK APPLICABLE BOX BELOW, GIVE EXPLANATION ON BACK OF CARD, AND FILE WITH FORMS NYC-2 AND NYC-3 WITHIN 30 DAYS.

BUSINESS SOLD CEASED PAYING WAGES BUSINESS PERMANENTLY DISCONTINUED |

||

| THIS IS TO CERTIFY THAT, EXCEPT FOR CORRECTIONS REQUIRED FOR PRIOR PERIODS IN 1973, THE AGGREGATE AMOUNT OF TAX WITHHELD SHOWN ON THIS RETURN IS CORRECT FOR THE PERIOD REPORTED. |

TELEPHONE

NUMBER 360-1797 |

||

| L. H. Lushbough | Exec. Secty. | 3/11/74 | |

| SIGNATURE | TITLE | DATE | |

PRINTED IN U.S.A.

MAIL REMITTANCE TO: THE CITY OF NEW YORK, FINANCE ADMINISTRATION, DEPARTMENT OF TAX COLLECTION, BOX 3800, GENERAL POST OFFICE, NEW YORK, N.Y. 10001