Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

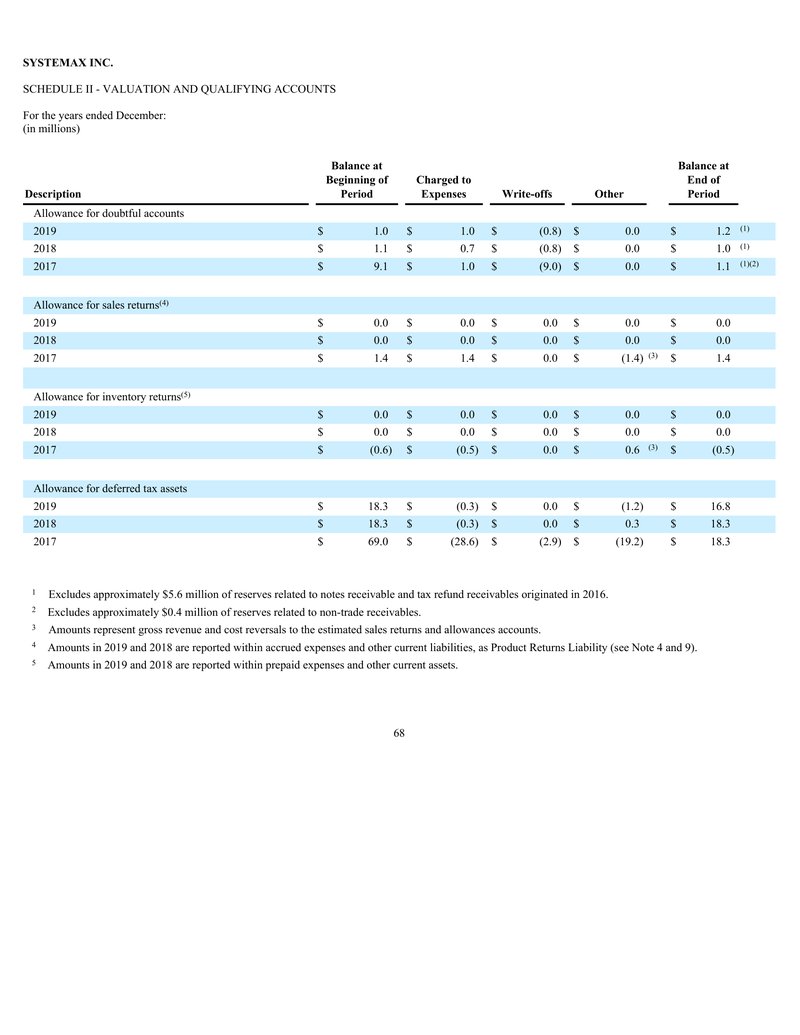

SYSTEMAX INC.

SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS

For the years ended December:

(in millions)

| Description |

Balance at

Beginning of Period |

Charged to

Expenses |

Write-offs | Other |

Balance at

End of Period |

|---|---|---|---|---|---|

| Allowance for doubtful accounts | |||||

| 2019 | $ 1.0 | $ 1.0 | $ (0.8) | $ 0.0 | $ 1.2 (1) |

| 2018 | $ 1.1 | $ 0.7 | $ (0.8) | $ 0.0 | $ 1.0 (1) |

| 2017 | $ 9.1 | $ 1.0 | $ (9.0) | $ 0.0 | $ 1.1 (1)(2) |

| Allowance for sales returns (4) | |||||

| 2019 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 |

| 2018 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 |

| 2017 | $ 1.4 | $ 1.4 | $ 0.0 | $ (1.4) (3) | $ 1.4 |

| Allowance for inventory returns (5) | |||||

| 2019 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 |

| 2018 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 | $ 0.0 |

| 2017 | $ (0.6) | $ (0.5) | $ 0.0 | $ 0.6 (3) | $ (0.5) |

| Allowance for deferred tax assets | |||||

| 2019 | $ 18.3 | $ (0.3) | $ 0.0 | $ (1.2) | $ 16.8 |

| 2018 | $ 18.3 | $ (0.3) | $ 0.0 | $ 0.3 | $ 18.3 |

| 2017 | $ 69.0 | $ (28.6) | $ (2.9) | $ (19.2) | $ 18.3 |

1 Excludes approximately $5.6 million of reserves related to notes receivable and tax refund receivables originated in 2016.

2 Excludes approximately $0.4 million of reserves related to non-trade receivables.

3 Amounts represent gross revenue and cost reversals to the estimated sales returns and allowances accounts.

4 Amounts in 2019 and 2018 are reported within accrued expenses and other current liabilities, as Product Returns Liability (see Note 4 and 9).

5 Amounts in 2019 and 2018 are reported within prepaid expenses and other current assets.

68