Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

JACK IN THE BOX INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

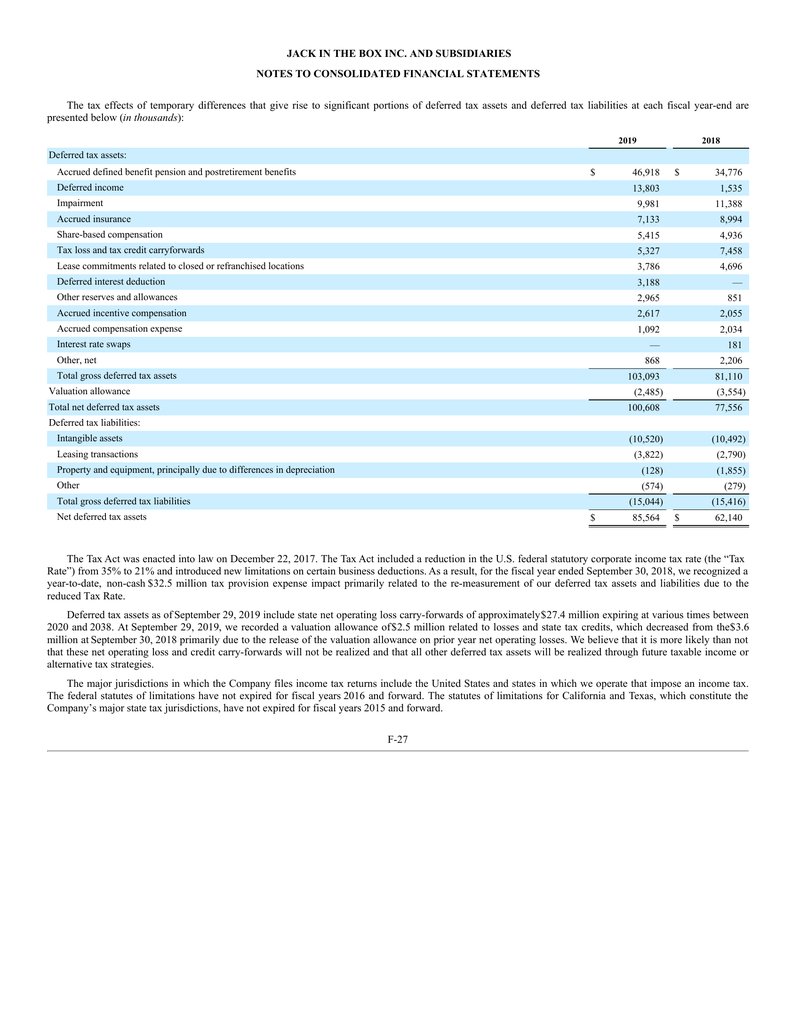

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax liabilities at each fiscal year-end are presented below (in thousands):

| 2019 | 2018 | |

|---|---|---|

| Deferred tax assets: | ||

| Accrued defined benefit pension and postretirement benefits | $ 46,918 | $ 34,776 |

| Deferred income | 13,803 | 1,535 |

| Impairment | 9,981 | 11,388 |

| Accrued insurance | 7,133 | 8,994 |

| Share-based compensation | 5,415 | 4,936 |

| Tax loss and tax credit carryforwards | 5,327 | 7,458 |

| Lease commitments related to closed or refranchised locations | 3,786 | 4,696 |

| Deferred interest deduction | 3,188 | — |

| Other reserves and allowances | 2,965 | 851 |

| Accrued incentive compensation | 2,617 | 2,055 |

| Accrued compensation expense | 1,092 | 2,034 |

| Interest rate swaps | — | 181 |

| Other, net | 868 | 2,206 |

| Total gross deferred tax assets | 103,093 | 81,110 |

| Valuation allowance | (2,485) | (3,554) |

| Total net deferred tax assets | 100,608 | 77,556 |

| Deferred tax liabilities: | ||

| Intangible assets | (10,520) | (10,492) |

| Leasing transactions | (3,822) | (2,790) |

| Property and equipment, principally due to differences in depreciation | (128) | (1,855) |

| Other | (574) | (279) |

| Total gross deferred tax liabilities | (15,044) | (15,416) |

| Net deferred tax assets | $ 85,564 | $ 62,140 |

The Tax Act was enacted into law on December 22, 2017. The Tax Act included a reduction in the U.S. federal statutory corporate income tax rate (the “Tax Rate”) from 35% to 21% and introduced new limitations on certain business deductions. As a result, for the fiscal year ended September 30, 2018, we recognized a year-to-date, non-cash $32.5 million tax provision expense impact primarily related to the re-measurement of our deferred tax assets and liabilities due to the reduced Tax Rate.

Deferred tax assets as of September 29, 2019 include state net operating loss carry-forwards of approximately $27.4 million expiring at various times between 2020 and 2038. At September 29, 2019, we recorded a valuation allowance of $2.5 million related to losses and state tax credits, which decreased from the $3.6 million at September 30, 2018 primarily due to the release of the valuation allowance on prior year net operating losses. We believe that it is more likely than not that these net operating loss and credit carry-forwards will not be realized and that all other deferred tax assets will be realized through future taxable income or alternative tax strategies.

The major jurisdictions in which the Company files income tax returns include the United States and states in which we operate that impose an income tax. The federal statutes of limitations have not expired for fiscal years 2016 and forward. The statutes of limitations for California and Texas, which constitute the Company’s major state tax jurisdictions, have not expired for fiscal years 2015 and forward.

F-27