Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

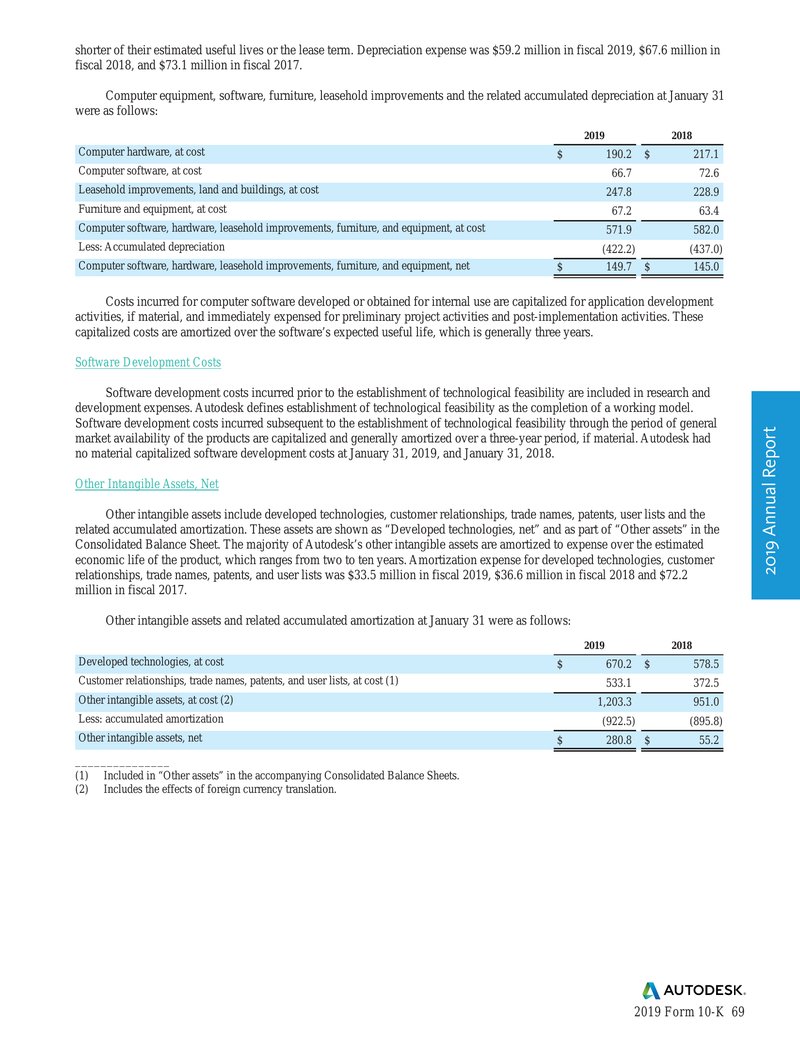

shorter of their estimated useful lives or the lease term. Depreciation expense was $59.2 million in fiscal 2019, $67.6 million in fiscal 2018, and $73.1 million in fiscal 2017.

Computer equipment, software, furniture, leasehold improvements and the related accumulated depreciation at January 31 were as follows:

| 2019 | 2018 | |

|---|---|---|

| Computer hardware, at cost | $ 190.2 | $ 217.1 |

| Computer software, at cost | 66.7 | 72.6 |

| Leasehold improvements, land and buildings, at cost | 247.8 | 228.9 |

| Furniture and equipment, at cost | 67.2 | 63.4 |

| Computer software, hardware, leasehold improvements, furniture, and equipment, at cost | 571.9 | 582.0 |

| Less: Accumulated depreciation | (422.2) | (437.0) |

| Computer software, hardware, leasehold improvements, furniture, and equipment, net | $ 149.7 | $ 145.0 |

Costs incurred for computer software developed or obtained for internal use are capitalized for application development activities, if material, and immediately expensed for preliminary project activities and post-implementation activities. These capitalized costs are amortized over the software's expected useful life, which is generally three years.

Software Development Costs

Software development costs incurred prior to the establishment of technological feasibility are included in research and development expenses. Autodesk defines establishment of technological feasibility as the completion of a working model. Software development costs incurred subsequent to the establishment of technological feasibility through the period of general market availability of the products are capitalized and generally amortized over a three-year period, if material. Autodesk had no material capitalized software development costs at January 31, 2019, and January 31, 2018.

Other Intangible Assets, Net

Other intangible assets include developed technologies, customer relationships, trade names, patents, user lists and the related accumulated amortization. These assets are shown as “Developed technologies, net” and as part of “Other assets” in the Consolidated Balance Sheet. The majority of Autodesk's other intangible assets are amortized to expense over the estimated economic life of the product, which ranges from two to ten years. Amortization expense for developed technologies, customer relationships, trade names, patents, and user lists was $33.5 million in fiscal 2019, $36.6 million in fiscal 2018 and $72.2 million in fiscal 2017.

Other intangible assets and related accumulated amortization at January 31 were as follows:

| 2019 | 2018 | |

|---|---|---|

| Developed technologies, at cost | $ 670.2 | $ 578.5 |

| Customer relationships, trade names, patents, and user lists, at cost (1) | 533.1 | 372.5 |

| Other intangible assets, at cost (2) | 1,203.3 | 951.0 |

| Less: accumulated amortization | (922.5) | (895.8) |

| Other intangible assets, net | $ 280.8 | $ 55.2 |

(1) Included in “Other assets” in the accompanying Consolidated Balance Sheets.

(2) Includes the effects of foreign currency translation.

2019 Annual Report

AUTODESK.

2019 Form 10-K 69