Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales Page 1 of 1

财信证券

CHASING SECURITIES

CHASING SECURITIES

公司研究报告

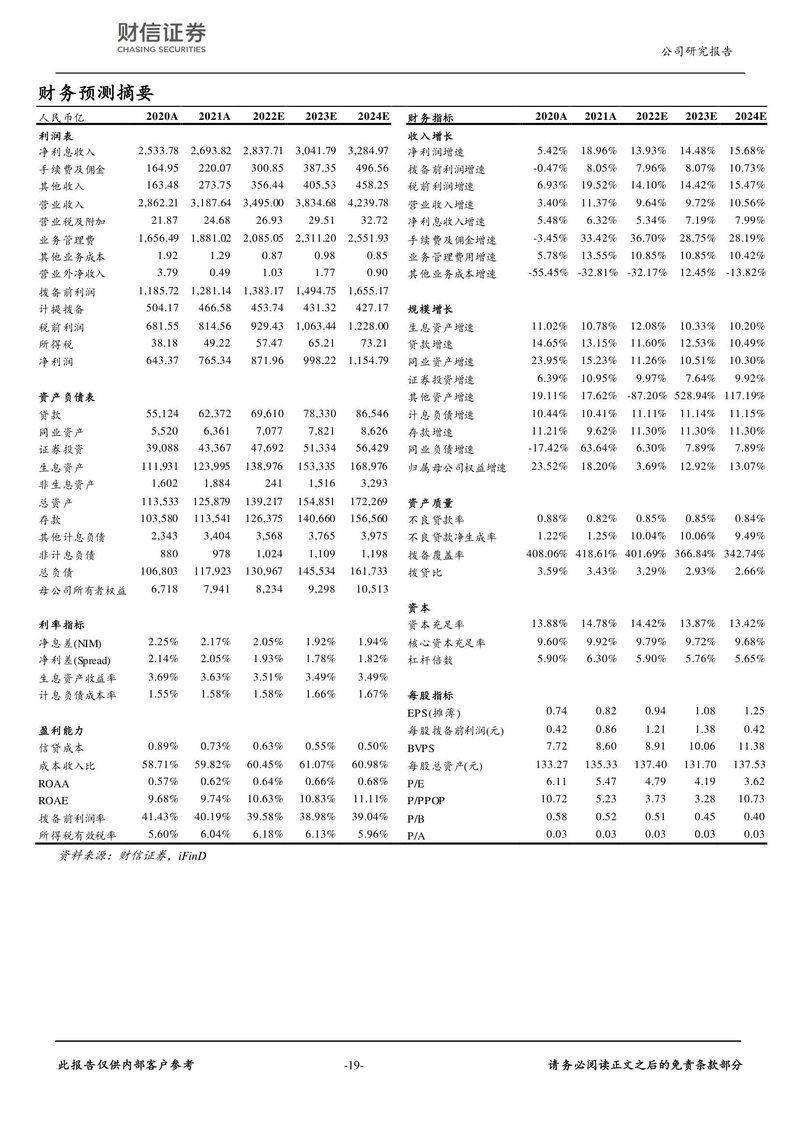

财务预测摘要

| 人民币亿 | 2020A | 2021A | 2022E | 2023E | 2024E | 财务指标 | 2020A | 2021A | 2022E | 2023E | 2024E |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 利润表 | 收入增长 | ||||||||||

| 净利息收入 | 2,533.78 | 2,693.82 | 2,837.71 | 3,041.79 | 3,284.97 | 净利润增速 | 5.42% | 18.96% | 13.93% | 14.48% | 15.68% |

| 手续费及佣金 | 164.95 | 220.07 | 300.85 | 387.35 | 496.56 | 拨备前利润增速 | -0.47% | 8.05% | 7.96% | 8.07% | 10.73% |

| 其他收入 | 163.48 | 273.75 | 356.44 | 405.53 | 458.25 | 税前利润增速 | 6.93% | 19.52% | 14.10% | 14.42% | 15.47% |

| 营业收入 | 2,862.21 | 3,187.64 | 3,495.00 | 3,834.68 | 4,239.78 | 营业收入增速 | 3.40% | 11.37% | 9.64% | 9.72% | 10.56% |

| 营业税及附加 | 21.87 | 24.68 | 26.93 | 29.51 | 32.72 | 净利息收入增速 | 5.48% | 6.32% | 5.34% | 7.19% | 7.99% |

| 业务管理费 | 1,656.49 | 1,881.02 | 2,085.05 | 2,311.20 | 2,551.93 | 手续费及佣金增速 | -3.45% | 33.42% | 36.70% | 28.75% | 28.19% |

| 其他业务成本 | 1.92 | 1.29 | 0.87 | 0.98 | 0.85 | 业务管理费用增速 | 5.78% | 13.55% | 10.85% | 10.85% | 10.42% |

| 营业外净收入 | 3.79 | 0.49 | 1.03 | 1.77 | 0.90 | 其他业务成本增速 | -55.45% | -32.81% | -32.17% | 12.45% | -13.82% |

| 拨备前利润 | 1,185.72 | 1,281.14 | 1,383.17 | 1,494.75 | 1,655.17 | 规模增长 | |||||

| 计提拨备 | 504.17 | 466.58 | 453.74 | 431.32 | 427.17 | 生息资产增速 | 11.02% | 10.78% | 12.08% | 10.33% | 10.20% |

| 税前利润 | 681.55 | 814.56 | 929.43 | 1,063.44 | 1,228.00 | 贷款增速 | 14.65% | 13.15% | 11.60% | 12.53% | 10.49% |

| 所得税 | 38.18 | 49.22 | 57.47 | 65.21 | 73.21 | 同业资产增速 | 23.95% | 15.23% | 11.26% | 10.51% | 10.30% |

| 净利润 | 643.37 | 765.34 | 871.96 | 998.22 | 1,154.79 | 证券投资增速 | 6.39% | 10.95% | 9.97% | 7.64% | 9.92% |

| 资产负债表 | 其他资产增速 | 19.11% | 17.62% | -87.20% | 528.94% | 117.19% | |||||

| 贷款 | 55,124 | 62,372 | 69,610 | 78,330 | 86,546 | 计息负债增速 | 10.44% | 10.41% | 11.11% | 11.14% | 11.15% |

| 同业资产 | 5,520 | 6,361 | 7,077 | 7,821 | 8,626 | 存款增速 | 11.21% | 9.62% | 11.30% | 11.30% | 11.30% |

| 证券投资 | 39,088 | 43,367 | 47,692 | 51,334 | 56,429 | 同业负债增速 | -17.42% | 63.64% | 6.30% | 7.89% | 7.89% |

| 生息资产 | 111,931 | 123,995 | 138,976 | 153,335 | 168,976 | 归属母公司权益增速 | 23.52% | 18.20% | 3.69% | 12.92% | 13.07% |

| 非生息资产 | 1,602 | 1,884 | 241 | 1,516 | 3,293 | 资产质量 | |||||

| 总资产 | 113,533 | 125,879 | 139,217 | 154,851 | 172,269 | 不良贷款率 | 0.88% | 0.82% | 0.85% | 0.85% | 0.84% |

| 存款 | 103,580 | 113,541 | 126,375 | 140,660 | 156,560 | 不良贷款净生成率 | 1.22% | 1.25% | 10.04% | 10.06% | 9.49% |

| 其他计息负债 | 2,343 | 3,404 | 3,568 | 3,765 | 3,975 | 拨备覆盖率 | 408.06% | 418.61% | 401.69% | 366.84% | 342.74% |

| 非计息负债 | 880 | 978 | 1,024 | 1,109 | 1,198 | 拨贷比 | 3.59% | 3.43% | 3.29% | 2.93% | 2.66% |

| 总负债 | 106,803 | 117,923 | 130,967 | 145,534 | 161,733 | 资本 | |||||

| 母公司所有者权益 | 6,718 | 7,941 | 8,234 | 9,298 | 10,513 | 资本充足率 | 13.88% | 14.78% | 14.42% | 13.87% | 13.42% |

| 利率指标 | 核心资本充足率 | 9.60% | 9.92% | 9.79% | 9.72% | 9.68% | |||||

| 净息差(NIM) | 2.25% | 2.17% | 2.05% | 1.92% | 1.94% | 杠杆倍数 | 5.90% | 6.30% | 5.90% | 5.76% | 5.65% |

| 净利差(Spread) | 2.14% | 2.05% | 1.93% | 1.78% | 1.82% | 每股指标 | |||||

| 生息资产收益率 | 3.69% | 3.63% | 3.51% | 3.49% | 3.49% | EPS(摊薄) | 0.74 | 0.82 | 0.94 | 1.08 | 1.25 |

| 计息负债成本率 | 1.55% | 1.58% | 1.58% | 1.66% | 1.67% | 每股拨备前利润(元) | 0.42 | 0.86 | 1.21 | 1.38 | 0.42 |

| 盈利能力 | BVPS | 7.72 | 8.60 | 8.91 | 10.06 | 11.38 | |||||

| 信贷成本 | 0.89% | 0.73% | 0.63% | 0.55% | 0.50% | 每股总资产(元) | 133.27 | 135.33 | 137.40 | 131.70 | 137.53 |

| 成本收入比 | 58.71% | 59.82% | 60.45% | 61.07% | 60.98% | P/E | 6.11 | 5.47 | 4.79 | 4.19 | 3.62 |

| ROAA | 0.57% | 0.62% | 0.64% | 0.66% | 0.68% | P/PPOP | 10.72 | 5.23 | 3.73 | 3.28 | 10.73 |

| ROAE | 9.68% | 9.74% | 10.63% | 10.83% | 11.11% | P/B | 0.58 | 0.52 | 0.51 | 0.45 | 0.40 |

| 拨备前利润率 | 41.43% | 40.19% | 39.58% | 38.98% | 39.04% | P/A | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| 所得税有效税率 | 5.60% | 6.04% | 6.18% | 6.13% | 5.96% | ||||||

资料来源:财信证券, iFinD

此报告仅供内部客户参考

-19-

请务必阅读正文之后的免责条款部分