Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

AMERICAN TOWER CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular amounts in millions, unless otherwise disclosed)

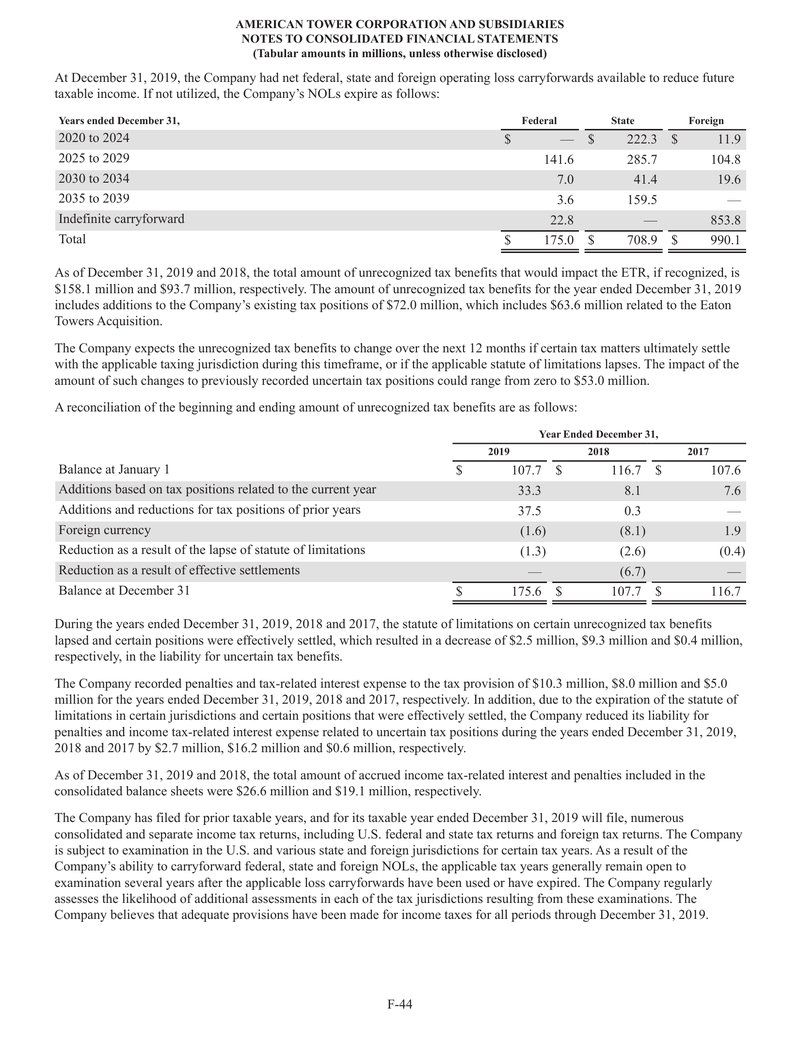

At December 31, 2019, the Company had net federal, state and foreign operating loss carryforwards available to reduce future taxable income. If not utilized, the Company's NOLs expire as follows:

| Years ended December 31, | Federal | State | Foreign |

|---|---|---|---|

| $ | $ | $ | |

| 2020 to 2024 | — | 222.3 | 11.9 |

| 2025 to 2029 | 141.6 | 285.7 | 104.8 |

| 2030 to 2034 | 7.0 | 41.4 | 19.6 |

| 2035 to 2039 | 3.6 | 159.5 | — |

| Indefinite carryforward | 22.8 | — | 853.8 |

| Total | $ 175.0 | $ 708.9 | $ 990.1 |

As of December 31, 2019 and 2018, the total amount of unrecognized tax benefits that would impact the ETR, if recognized, is $158.1 million and $93.7 million, respectively. The amount of unrecognized tax benefits for the year ended December 31, 2019 includes additions to the Company's existing tax positions of $72.0 million, which includes $63.6 million related to the Eaton Towers Acquisition.

The Company expects the unrecognized tax benefits to change over the next 12 months if certain tax matters ultimately settle with the applicable taxing jurisdiction during this timeframe, or if the applicable statute of limitations lapses. The impact of the amount of such changes to previously recorded uncertain tax positions could range from zero to $53.0 million.

A reconciliation of the beginning and ending amount of unrecognized tax benefits are as follows:

| Year Ended December 31, | |||

|---|---|---|---|

| 2019 | 2018 | 2017 | |

| Balance at January 1 | $ 107.7 | $ 116.7 | $ 107.6 |

| Additions based on tax positions related to the current year | 33.3 | 8.1 | 7.6 |

| Additions and reductions for tax positions of prior years | 37.5 | 0.3 | — |

| Foreign currency | (1.6) | (8.1) | 1.9 |

| Reduction as a result of the lapse of statute of limitations | (1.3) | (2.6) | (0.4) |

| Reduction as a result of effective settlements | — | (6.7) | — |

| Balance at December 31 | $ 175.6 | $ 107.7 | $ 116.7 |

During the years ended December 31, 2019, 2018 and 2017, the statute of limitations on certain unrecognized tax benefits lapsed and certain positions were effectively settled, which resulted in a decrease of $2.5 million, $9.3 million and $0.4 million, respectively, in the liability for uncertain tax benefits.

The Company recorded penalties and tax-related interest expense to the tax provision of $10.3 million, $8.0 million and $5.0 million for the years ended December 31, 2019, 2018 and 2017, respectively. In addition, due to the expiration of the statute of limitations in certain jurisdictions and certain positions that were effectively settled, the Company reduced its liability for penalties and income tax-related interest expense related to uncertain tax positions during the years ended December 31, 2019, 2018 and 2017 by $2.7 million, $16.2 million and $0.6 million, respectively.

As of December 31, 2019 and 2018, the total amount of accrued income tax-related interest and penalties included in the consolidated balance sheets were $26.6 million and $19.1 million, respectively.

The Company has filed for prior taxable years, and for its taxable year ended December 31, 2019 will file, numerous consolidated and separate income tax returns, including U.S. federal and state tax returns and foreign tax returns. The Company is subject to examination in the U.S. and various state and foreign jurisdictions for certain tax years. As a result of the Company's ability to carryforward federal, state and foreign NOLs, the applicable tax years generally remain open to examination several years after the applicable loss carryforwards have been used or have expired. The Company regularly assesses the likelihood of additional assessments in each of the tax jurisdictions resulting from these examinations. The Company believes that adequate provisions have been made for income taxes for all periods through December 31, 2019.

F-44