Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

ASMI ANNUAL REPORT 2019

ABOUT

VALUE CREATION

GOVERNANCE

FINANCIAL STATEMENTS

GENERAL INFORMATION

<123>

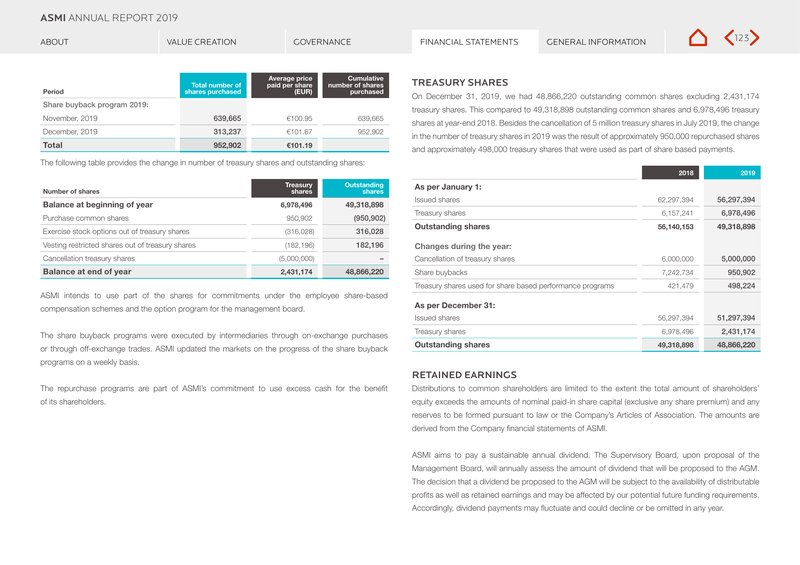

| Period | Total number of shares purchased | Average price paid per share (EUR) | Cumulative number of shares purchased |

|---|---|---|---|

| Share buyback program 2019: | |||

| November, 2019 | 639,665 | €100.95 | 639,665 |

| December, 2019 | 313,237 | €101.67 | 952,902 |

| Total | 952,902 | €101.19 | 952,902 |

The following table provides the change in number of treasury shares and outstanding shares:

| Number of shares | Treasury shares | Outstanding shares |

|---|---|---|

| Balance at beginning of year | 6,978,496 | 49,318,898 |

| Purchase common shares | 950,902 | (950,902) |

| Exercise stock options out of treasury shares | (316,028) | 316,028 |

| Vesting restricted shares out of treasury shares | (182,196) | 182,196 |

| Cancellation treasury shares | (5,000,000) | - |

| Balance at end of year | 2,431,174 | 48,866,220 |

ASMI intends to use part of the shares for commitments under the employee share-based compensation schemes and the option program for the management board.

The share buyback programs were executed by intermediaries through on-exchange purchases or through off-exchange trades. ASMI updated the markets on the progress of the share buyback programs on a weekly basis.

The repurchase programs are part of ASMI's commitment to use excess cash for the benefit of its shareholders.

TREASURY SHARES

On December 31, 2019, we had 48,866,220 outstanding common shares excluding 2,431,174 treasury shares. This compared to 49,318,898 outstanding common shares and 6,978,496 treasury shares at year-end 2018. Besides the cancellation of 5 million treasury shares in July 2019, the change in the number of treasury shares in 2019 was the result of approximately 950,000 repurchased shares and approximately 498,000 treasury shares that were used as part of share based payments.

| 2018 | 2019 | |

|---|---|---|

| As per January 1: | ||

| Issued shares | 62,297,394 | 56,297,394 |

| Treasury shares | 6,157,241 | 6,978,496 |

| Outstanding shares | 56,140,153 | 49,318,898 |

| Changes during the year: | ||

| Cancellation of treasury shares | 6,000,000 | 5,000,000 |

| Share buybacks | 7,242,734 | 950,902 |

| Treasury shares used for share based performance programs | 421,479 | 498,224 |

| As per December 31: | ||

| Issued shares | 56,297,394 | 51,297,394 |

| Treasury shares | 6,978,496 | 2,431,174 |

| Outstanding shares | 49,318,898 | 48,866,220 |

RETAINED EARNINGS

Distributions to common shareholders are limited to the extent the total amount of shareholders' equity exceeds the amounts of nominal paid-in share capital (exclusive any share premium) and any reserves to be formed pursuant to law or the Company's Articles of Association. The amounts are derived from the Company financial statements of ASMI.

ASMI aims to pay a sustainable annual dividend. The Supervisory Board, upon proposal of the Management Board, will annually assess the amount of dividend that will be proposed to the AGM. The decision that a dividend be proposed to the AGM will be subject to the availability of distributable profits as well as retained earnings and may be affected by our potential future funding requirements. Accordingly, dividend payments may fluctuate and could decline or be omitted in any year.