Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales Page 1 of 1

国金证券

SINOLINK SECURITIES

SINOLINK SECURITIES

公司点评

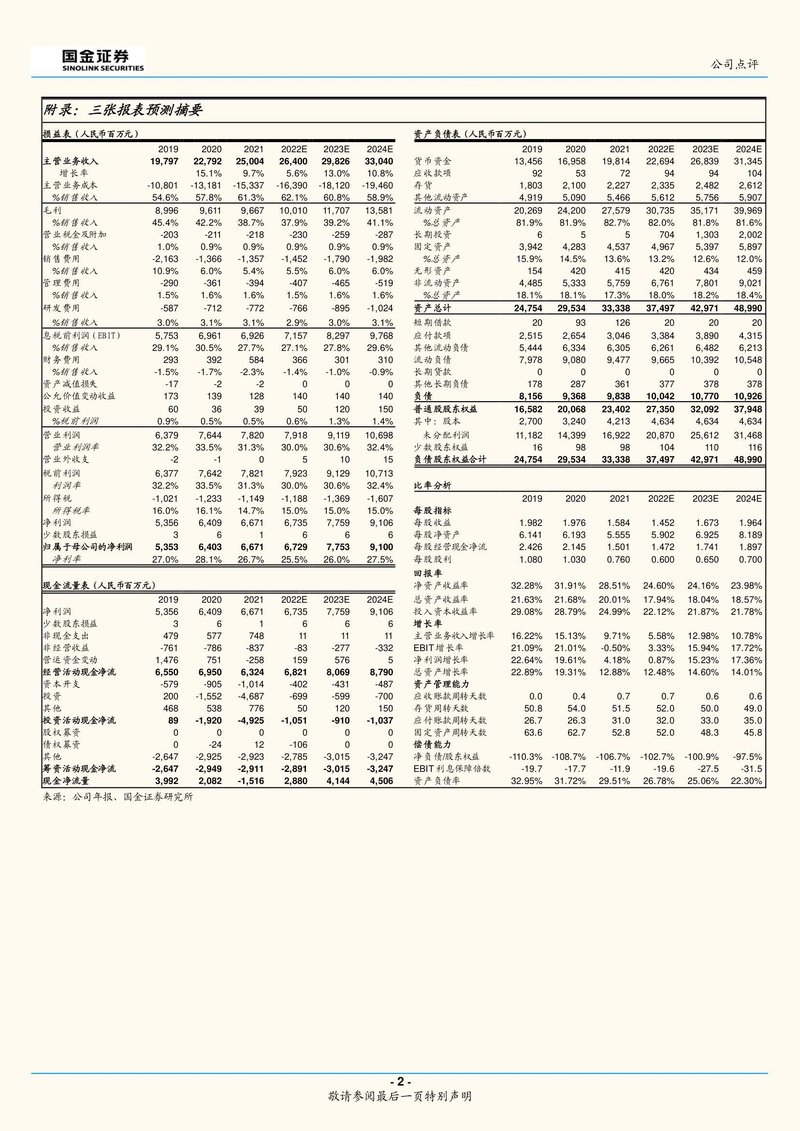

附录:三张报表预测摘要

损益表 (人民币百万元)

| 2019 | 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|---|

| 主营业务收入 | 19,797 | 22,792 | 25,004 | 26,400 | 29,826 | 33,040 |

| 增长率 | 15.1% | 9.7% | 5.6% | 13.0% | 10.8% | |

| 主营业务成本 | -10,801 | -13,181 | -15,337 | -16,390 | -18,120 | -19,460 |

| %销售收入 | 54.6% | 57.8% | 61.3% | 62.1% | 60.8% | 58.9% |

| 毛利 | 8,996 | 9,611 | 9,667 | 10,010 | 11,707 | 13,581 |

| %销售收入 | 45.4% | 42.2% | 38.7% | 37.9% | 39.2% | 41.1% |

| 营业税金及附加 | -203 | -211 | -218 | -230 | -259 | -287 |

| %销售收入 | 1.0% | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% |

| 销售费用 | -2,163 | -1,366 | -1,357 | -1,452 | -1,790 | -1,982 |

| %销售收入 | 10.9% | 6.0% | 5.4% | 5.5% | 6.0% | 6.0% |

| 管理费用 | -290 | -361 | -394 | -407 | -465 | -519 |

| %销售收入 | 1.5% | 1.6% | 1.6% | 1.5% | 1.6% | 1.6% |

| 研发费用 | -587 | -712 | -772 | -766 | -895 | -1,024 |

| %销售收入 | 3.0% | 3.1% | 3.1% | 2.9% | 3.0% | 3.1% |

| 息税前利润(EBIT) | 5,753 | 6,961 | 6,926 | 7,157 | 8,297 | 9,768 |

| %销售收入 | 29.1% | 30.5% | 27.7% | 27.1% | 27.8% | 29.6% |

| 财务费用 | 293 | 392 | 584 | 366 | 301 | 310 |

| %销售收入 | -1.5% | -1.7% | -2.3% | -1.4% | -1.0% | -0.9% |

| 资产减值损失 | -17 | -2 | -2 | 0 | 0 | 0 |

| 公允价值变动收益 | 173 | 139 | 128 | 140 | 140 | 140 |

| 投资收益 | 60 | 36 | 39 | 50 | 120 | 150 |

| %税前利润 | 0.9% | 0.5% | 0.5% | 0.6% | 1.3% | 1.4% |

| 营业利润 | 6,379 | 7,644 | 7,820 | 7,918 | 9,119 | 10,698 |

| 营业利润率 | 32.2% | 33.5% | 31.3% | 30.0% | 30.6% | 32.4% |

| 营业外收支 | -2 | -1 | 0 | 5 | 10 | 15 |

| 税前利润 | 6,377 | 7,642 | 7,821 | 7,923 | 9,129 | 10,713 |

| 利润率 | 32.2% | 33.5% | 31.3% | 30.0% | 30.6% | 32.4% |

| 所得税 | -1,021 | -1,233 | -1,149 | -1,188 | -1,369 | -1,607 |

| 所得税率 | 16.0% | 16.1% | 14.7% | 15.0% | 15.0% | 15.0% |

| 净利润 | 5,356 | 6,409 | 6,671 | 6,735 | 7,759 | 9,106 |

| 少数股东损益 | 3 | 6 | 1 | 6 | 6 | 6 |

| 归属于母公司的净利润 | 5,353 | 6,403 | 6,671 | 6,729 | 7,753 | 9,100 |

| 净利率 | 27.0% | 28.1% | 26.7% | 25.5% | 26.0% | 27.5% |

现金流量表 (人民币百万元)

| 2019 | 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|---|

| 净利润 | 5,356 | 6,409 | 6,671 | 6,735 | 7,759 | 9,106 |

| 少数股东损益 | 3 | 6 | 1 | 6 | 6 | 6 |

| 非现金支出 | 479 | 577 | 748 | 11 | 11 | 11 |

| 非经营收益 | -761 | -786 | -837 | -83 | -277 | -332 |

| 营运资金变动 | 1,476 | 751 | -258 | 159 | 576 | 5 |

| 经营活动现金净流 | 6,550 | 6,950 | 6,324 | 6,821 | 8,069 | 8,790 |

| 资本开支 | -579 | -905 | -1,014 | -402 | -431 | -487 |

| 投资 | 200 | -1,552 | -4,687 | -699 | -599 | -700 |

| 其他 | 468 | 538 | 776 | 50 | 120 | 150 |

| 投资活动现金净流 | 89 | -1,920 | -4,925 | -1,051 | -910 | -1,037 |

| 股权募资 | 0 | 0 | 0 | 0 | 0 | 0 |

| 债权募资 | 0 | -24 | 12 | -106 | 0 | 0 |

| 其他 | -2,647 | -2,925 | -2,923 | -2,785 | -3,015 | -3,247 |

| 筹资活动现金净流 | -2,647 | -2,949 | -2,911 | -2,891 | -3,015 | -3,247 |

| 现金净流量 | 3,992 | 2,082 | -1,516 | 2,880 | 4,144 | 4,506 |

资产负债表 (人民币百万元)

| 2019 | 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|---|

| 货币资金 | 13,456 | 16,958 | 19,814 | 22,694 | 26,839 | 31,345 |

| 应收款项 | 92 | 53 | 72 | 94 | 94 | 104 |

| 存货 | 1,803 | 2,100 | 2,227 | 2,335 | 2,482 | 2,612 |

| 其他流动资产 | 4,919 | 5,090 | 5,466 | 5,612 | 5,756 | 5,907 |

| 流动资产 | 20,269 | 24,200 | 27,579 | 30,735 | 35,171 | 39,969 |

| %总资产 | 81.9% | 81.9% | 82.7% | 82.0% | 81.8% | 81.6% |

| 长期投资 | 6 | 5 | 5 | 704 | 1,303 | 2,002 |

| 固定资产 | 3,942 | 4,283 | 4,537 | 4,967 | 5,397 | 5,897 |

| %总资产 | 15.9% | 14.5% | 13.6% | 13.2% | 12.6% | 12.0% |

| 无形资产 | 154 | 420 | 415 | 420 | 434 | 459 |

| 非流动资产 | 4,485 | 5,333 | 5,759 | 6,761 | 7,801 | 9,021 |

| %总资产 | 18.1% | 18.1% | 17.3% | 18.0% | 18.2% | 18.4% |

| 资产总计 | 24,754 | 29,534 | 33,338 | 37,497 | 42,971 | 48,990 |

| 短期借款 | 20 | 93 | 126 | 20 | 20 | 20 |

| 应付款项 | 2,515 | 2,654 | 3,046 | 3,384 | 3,890 | 4,315 |

| 其他流动负债 | 5,444 | 6,334 | 6,305 | 6,261 | 6,482 | 6,213 |

| 流动负债 | 7,978 | 9,080 | 9,477 | 9,665 | 10,392 | 10,548 |

| 长期贷款 | 0 | 0 | 0 | 0 | 0 | 0 |

| 其他长期负债 | 178 | 287 | 361 | 377 | 378 | 378 |

| 负债 | 8,156 | 9,368 | 9,838 | 10,042 | 10,770 | 10,926 |

| 普通股股东权益 | 16,582 | 20,068 | 23,402 | 27,350 | 32,092 | 37,948 |

| 其中:股本 | 2,700 | 3,240 | 4,213 | 4,634 | 4,634 | 4,634 |

| 未分配利润 | 11,182 | 14,399 | 16,922 | 20,870 | 25,612 | 31,468 |

| 少数股东权益 | 16 | 98 | 98 | 104 | 110 | 116 |

| 负债股东权益合计 | 24,754 | 29,534 | 33,338 | 37,497 | 42,971 | 48,990 |

比率分析

| 2019 | 2020 | 2021 | 2022E | 2023E | 2024E | |

|---|---|---|---|---|---|---|

| 每股指标 | ||||||

| 每股收益 | 1.982 | 1.976 | 1.584 | 1.452 | 1.673 | 1.964 |

| 每股净资产 | 6.141 | 6.193 | 5.555 | 5.902 | 6.925 | 8.189 |

| 每股经营现金净流 | 2.426 | 2.145 | 1.501 | 1.472 | 1.741 | 1.897 |

| 每股股利 | 1.080 | 1.030 | 0.760 | 0.600 | 0.650 | 0.700 |

| 回报率 | ||||||

| 净资产收益率 | 32.28% | 31.91% | 28.51% | 24.60% | 24.16% | 23.98% |

| 总资产收益率 | 21.63% | 21.68% | 20.01% | 17.94% | 18.04% | 18.57% |

| 投入资本收益率 | 29.08% | 28.79% | 24.99% | 22.12% | 21.87% | 21.78% |

| 增长率 | ||||||

| 主营业务收入增长率 | 16.22% | 15.13% | 9.71% | 5.58% | 12.98% | 10.78% |

| EBIT增长率 | 21.09% | 21.01% | -0.50% | 3.33% | 15.94% | 17.72% |

| 净利润增长率 | 22.64% | 19.61% | 4.18% | 0.87% | 15.23% | 17.36% |

| 总资产增长率 | 22.89% | 19.31% | 12.88% | 12.48% | 14.60% | 14.01% |

| 资产管理能力 | ||||||

| 应收账款周转天数 | 0.0 | 0.4 | 0.7 | 0.7 | 0.6 | 0.6 |

| 存货周转天数 | 50.8 | 54.0 | 51.5 | 52.0 | 50.0 | 49.0 |

| 应付账款周转天数 | 26.7 | 26.3 | 31.0 | 32.0 | 33.0 | 35.0 |

| 固定资产周转天数 | 63.6 | 62.7 | 52.8 | 52.0 | 48.3 | 45.8 |

| 偿债能力 | ||||||

| 净负债/股东权益 | -110.3% | -108.7% | -106.7% | -102.7% | -100.9% | -97.5% |

| EBIT利息保障倍数 | -19.7 | -17.7 | -11.9 | -19.6 | -27.5 | -31.5 |

| 资产负债率 | 32.95% | 31.72% | 29.51% | 26.78% | 25.06% | 22.30% |

来源:公司年报、国金证券研究所

- 2 -

敬请参阅最后一页特别声明