Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

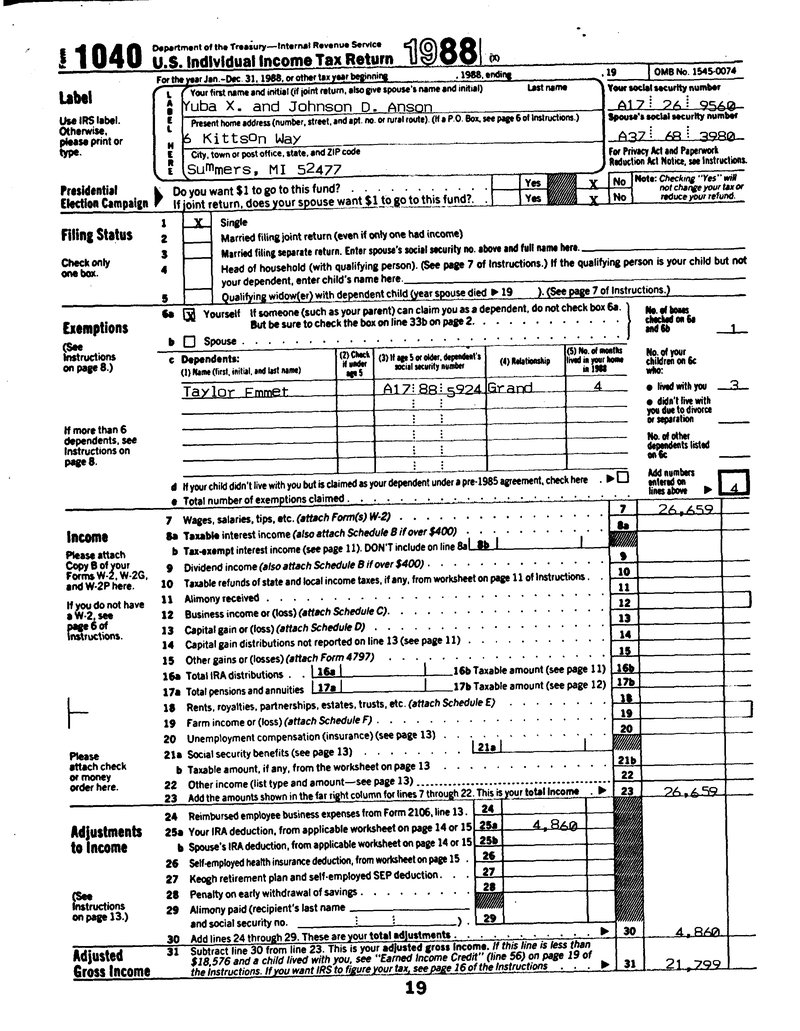

1040

Department of the Treasury—Internal Revenue Service

U.S. Individual Income Tax Return

1988

(x)

Label

Use IRS label.Otherwise,

please print or

type.

For the year Jan. - Dec. 31, 1988, or other tax year beginning

1988, ending

19

OMB No. 1545-0074

| Your first name and initial (if joint return, also give spouse's name and initial) | Last name |

| Yuba X. and Johnson D. Anson | |

| Present home address (number, street, and apt. no. or rural route). (If a P.O. Box, see page 6 of Instructions.) | Your social security number |

| 6 Kittson Way | A17: 26: 9560 |

| City, town or post office, state, and ZIP code | Spouse's social security number |

| Summers, MI 52477 | A37: 68: 3980 |

Reduction Act Notice, see Instructions.

Presidential

Election Campaign

Do you want $1 to go to this fund?

If joint return, does your spouse want $1 to go to this fund?

Yes

No

Yes

No

Note: Checking "Yes" willnot change your tax or

reduce your refund.

Filing Status

Check onlyone box.

| 1 | Single |

| 2 | Married filing joint return (even if only one had income) |

| 3 | Married filing separate return. Enter spouse's social security no. above and full name here. |

| 4 | Head of household (with qualifying person). (See page 7 of Instructions.) If the qualifying person is your child but not your dependent, enter child's name here. |

| 5 | Qualifying widow(er) with dependent child (year spouse died 19 ). (See page 7 of Instructions.) |

Exemptions

(SeeInstructions

on page 8.)

6a

Yourself If someone (such as your parent) can claim you as a dependent, do not check box 6a.

But be sure to check the box on line 33b on page 2.

checked on 6a

and 6b

1

b Spousec Dependents:

(1) Name (first, initial, and last name)

(2) Checkif under

age 5(3) If age 5 or older, dependent's

social security number

(4) Relationship

(5) No. of monthslived in your home

in 1988No. of your

children on 6c

who:

• lived with you

• didn't live with

you due to divorce

or separation

dependents listed

on 6c

Taylor Emmet

A17: 88: 5924

Grand

4

d If your child didn't live with you but is claimed as your dependent under a pre-1985 agreement, check here

e Total number of exemptions claimed

Add numbersentered on

lines above

4

If more than 6dependents, see

Instructions on

page 8.

Income

Please attachCopy B of your

Forms W-2, W-2G,

and W-2P here.If you do not have

a W-2, see

page 6 of

Instructions.

| 7 Wages, salaries, tips, etc. (attach Form(s) W-2) | 7 | 26,659 |

| 8a Taxable interest income (also attach Schedule B if over $400) | 8a | |

| b Tax-exempt interest income (see page 11). DON'T include on line 8a | 8b | |

| 9 Dividend income (also attach Schedule B if over $400) | 9 | |

| 10 Taxable refunds of state and local income taxes, if any, from worksheet on page 11 of Instructions. | 10 | |

| 11 Alimony received | 11 | |

| 12 Business income or (loss) (attach Schedule C). | 12 | |

| 13 Capital gain or (loss) (attach Schedule D) | 13 | |

| 14 Capital gain distributions not reported on line 13 (see page 11) | 14 | |

| 15 Other gains or (losses) (attach Form 4797) | 15 | |

| 16a Total IRA distributions | 16a | |

| 16b Taxable amount (see page 11) | 16b | |

| 17a Total pensions and annuities | 17a | |

| 17b Taxable amount (see page 12) | 17b | |

| 18 Rents, royalties, partnerships, estates, trusts, etc. (attach Schedule E) | 18 | |

| 19 Farm income or (loss) (attach Schedule F) | 19 | |

| 20 Unemployment compensation (insurance) (see page 13) | 20 | |

| 21a Social security benefits (see page 13) | 21a | |

| b Taxable amount, if any, from the worksheet on page 13 | 21b | |

| 22 Other income (list type and amount—see page 13) | 22 | |

| 23 Add the amounts shown in the far right column for lines 7 through 22. This is your total income | 23 | 26,659 |

Adjustments

to Income

(See

Instructions

on page 13.)

| 24 Reimbursed employee business expenses from Form 2106, line 13. | 24 | |

| 25a Your IRA deduction, from applicable worksheet on page 14 or 15 | 25a | 4,860 |

| b Spouse's IRA deduction, from applicable worksheet on page 14 or 15 | 25b | |

| 26 Self-employed health insurance deduction, from worksheet on page 15 | 26 | |

| 27 Keogh retirement plan and self-employed SEP deduction. | 27 | |

| 28 Penalty on early withdrawal of savings | 28 | |

|

29 Alimony paid (recipient's last name

and social security no.) |

29 | |

| 30 Add lines 24 through 29. These are your total adjustments. | 30 | 4,860 |

Adjusted

Gross Income

| 31 Subtract line 30 from line 23. This is your adjusted gross income. If this line is less than $18,576 and a child lived with you, see "Earned Income Credit" (line 56) on page 19 of the Instructions. If you want IRS to figure your tax, see page 16 of the Instructions. | 31 | 21,799 |

19