Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales Page 1 of 1

中泰证券

ZHONGTAI SECURITIES

ZHONGTAI SECURITIES

公司点评

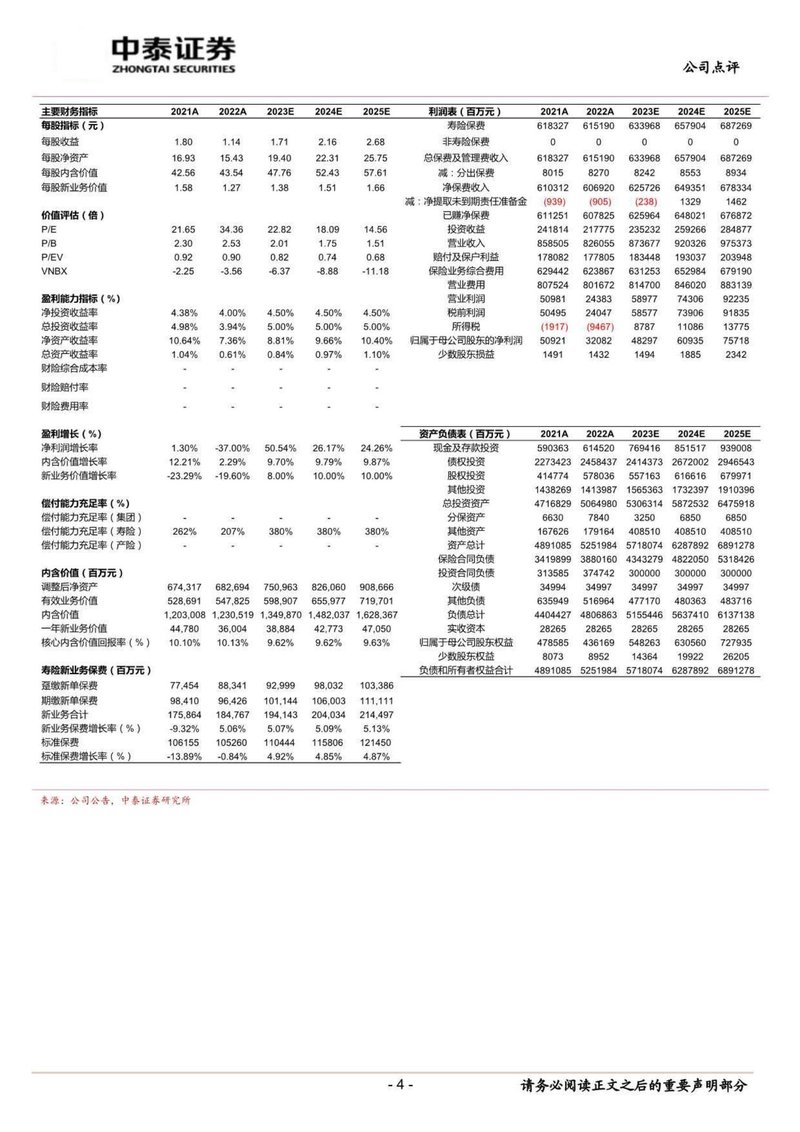

| 主要财务指标 | 2021A | 2022A | 2023E | 2024E | 2025E | 利润表(百万元) | 2021A | 2022A | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 每股指标(元) | 寿险保费 | 618,327 | 615,190 | 633,968 | 657,904 | 687,269 | |||||

| 每股收益 | 1.80 | 1.14 | 1.71 | 2.16 | 2.68 | 非寿险保费 | 0 | 0 | 0 | 0 | 0 |

| 每股净资产 | 16.93 | 15.43 | 19.40 | 22.31 | 25.75 | 总保费及管理费收入 | 618,327 | 615,190 | 633,968 | 657,904 | 687,269 |

| 每股内含价值 | 42.56 | 43.54 | 47.76 | 52.43 | 57.61 | 减:分出保费 | 8,015 | 8,270 | 8,242 | 8,553 | 8,934 |

| 每股新业务价值 | 1.58 | 1.27 | 1.38 | 1.51 | 1.66 | 净保费收入 | 610,312 | 606,920 | 625,726 | 649,351 | 678,334 |

| 价值评估(倍) | 减:净提取未到期责任准备金 | (939) | (905) | (238) | 1,329 | 1,462 | |||||

| P/E | 21.65 | 34.36 | 22.82 | 18.09 | 14.56 | 已赚净保费 | 611,251 | 607,825 | 625,964 | 648,021 | 676,872 |

| P/B | 2.30 | 2.53 | 2.01 | 1.75 | 1.51 | 投资收益 | 241,814 | 217,775 | 235,232 | 259,266 | 284,877 |

| P/EV | 0.92 | 0.90 | 0.82 | 0.74 | 0.68 | 营业收入 | 858,505 | 826,055 | 873,677 | 920,326 | 975,373 |

| VNBX | -2.25 | -3.56 | -6.37 | -8.88 | -11.18 | 赔付及保户利益 | 178,082 | 177,805 | 183,448 | 193,037 | 203,948 |

| 盈利能力指标(%) | 保险业务综合费用 | 629,442 | 623,867 | 631,253 | 652,984 | 679,190 | |||||

| 净投资收益率 | 4.38% | 4.00% | 4.50% | 4.50% | 4.50% | 营业费用 | 807,524 | 801,672 | 814,700 | 846,020 | 883,139 |

| 总投资收益率 | 4.98% | 3.94% | 5.00% | 5.00% | 5.00% | 营业利润 | 50,981 | 24,383 | 58,977 | 74,306 | 92,235 |

| 净资产收益率 | 10.64% | 7.36% | 8.81% | 9.66% | 10.40% | 税前利润 | 50,495 | 24,047 | 58,577 | 73,906 | 91,835 |

| 总资产收益率 | 1.04% | 0.61% | 0.84% | 0.97% | 1.10% | 所得税 | (1,917) | (9,467) | 8,787 | 11,086 | 13,775 |

| 财险综合成本率 | - | - | - | - | - | 归属于母公司股东的净利润 | 50,921 | 32,082 | 48,297 | 60,935 | 75,718 |

| 财险赔付率 | - | - | - | - | - | 少数股东损益 | 1,491 | 1,432 | 1,494 | 1,885 | 2,342 |

| 财险费用率 | - | - | - | - | - | ||||||

| 盈利增长(%) | 资产负债表(百万元) | 2021A | 2022A | 2023E | 2024E | 2025E | |||||

| 净利润增长率 | 1.30% | -37.00% | 50.54% | 26.17% | 24.26% | 现金及存款投资 | 590,363 | 614,520 | 769,416 | 851,517 | 939,008 |

| 内含价值增长率 | 12.21% | 2.29% | 9.70% | 9.79% | 9.87% | 债权投资 | 2,273,423 | 2,458,437 | 2,414,373 | 2,672,002 | 2,946,543 |

| 新业务价值增长率 | -23.29% | -19.60% | 8.00% | 10.00% | 10.00% | 股权投资 | 414,774 | 578,036 | 557,163 | 616,616 | 679,971 |

| 偿付能力充足率(%) | 其他投资 | 1,438,269 | 1,413,987 | 1,565,363 | 1,732,397 | 1,910,396 | |||||

| 偿付能力充足率(集团) | - | - | - | - | - | 总投资资产 | 4,716,829 | 5,064,980 | 5,306,314 | 5,872,532 | 6,475,918 |

| 偿付能力充足率(寿险) | 262% | 207% | 380% | 380% | 380% | 分保资产 | 6,630 | 7,840 | 3,250 | 6,850 | 6,850 |

| 偿付能力充足率(产险) | - | - | - | - | - | 其他资产 | 167,626 | 179,164 | 408,510 | 408,510 | 408,510 |

| 内含价值(百万元) | 资产总计 | 4,891,085 | 5,251,984 | 5,718,074 | 6,287,892 | 6,891,278 | |||||

| 调整后净资产 | 674,317 | 682,694 | 750,963 | 826,060 | 908,666 | 保险合同负债 | 3,419,899 | 3,880,160 | 4,343,279 | 4,822,050 | 5,318,426 |

| 有效业务价值 | 528,691 | 547,825 | 598,907 | 655,977 | 719,701 | 投资合同负债 | 313,585 | 374,742 | 300,000 | 300,000 | 300,000 |

| 内含价值 | 1,203,008 | 1,230,519 | 1,349,870 | 1,482,037 | 1,628,367 | 次级债 | 34,994 | 34,997 | 34,997 | 34,997 | 34,997 |

| 一年新业务价值 | 44,780 | 36,004 | 38,884 | 42,773 | 47,050 | 其他负债 | 635,949 | 516,964 | 477,170 | 480,363 | 483,716 |

| 核心内含价值回报率(%) | 10.10% | 10.13% | 9.62% | 9.62% | 9.63% | 负债总计 | 4,404,427 | 4,806,863 | 5,155,446 | 5,637,410 | 6,137,138 |

| 寿险新业务保费(百万元) | 实收资本 | 28,265 | 28,265 | 28,265 | 28,265 | 28,265 | |||||

| 趸缴新单保费 | 77,454 | 88,341 | 92,999 | 98,032 | 103,386 | 归属于母公司股东权益 | 478,585 | 436,169 | 548,263 | 630,560 | 727,935 |

| 期缴新单保费 | 98,410 | 96,426 | 101,144 | 106,003 | 111,111 | 少数股东权益 | 8,073 | 8,952 | 14,364 | 19,922 | 26,205 |

| 新业务合计 | 175,864 | 184,767 | 194,143 | 204,034 | 214,497 | 负债和所有者权益合计 | 4,891,085 | 5,251,984 | 5,718,074 | 6,287,892 | 6,891,278 |

| 新业务保费增长率(%) | -9.32% | 5.06% | 5.07% | 5.09% | 5.13% | ||||||

| 标准保费 | 106,155 | 105,260 | 110,444 | 115,806 | 121,450 | ||||||

| 标准保费增长率(%) | -13.89% | -0.84% | 4.92% | 4.85% | 4.87% |

来源:公司公告,中泰证券研究所

- 4 -

请务必阅读正文之后的重要声明部分