Benchmarks

View scores and output across OCR models spanning many document categories.

Want to run these evals on your own documents?

Talk to Sales

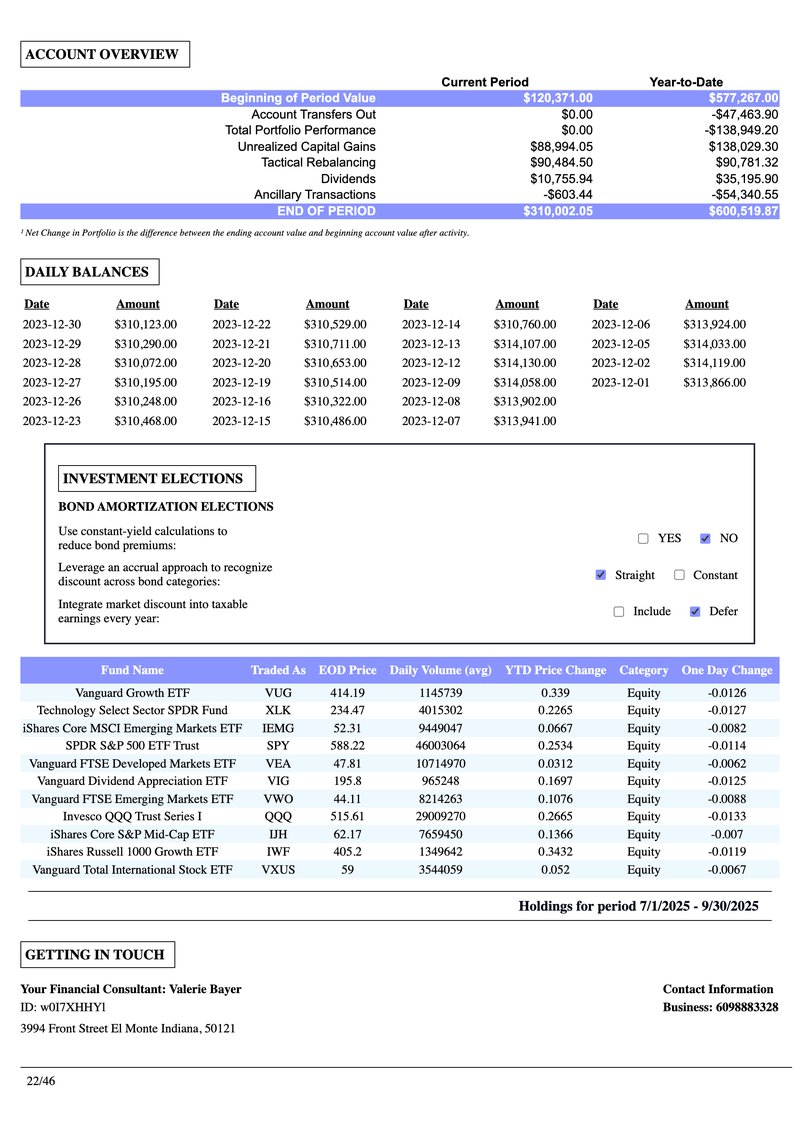

ACCOUNT OVERVIEW

| Current Period | Year-to-Date | |

|---|---|---|

| Beginning of Period Value | $120,371.00 | $577,267.00 |

| Account Transfers Out | $0.00 | -$47,463.90 |

| Total Portfolio Performance | $0.00 | -$138,949.20 |

| Unrealized Capital Gains | $88,994.05 | $138,029.30 |

| Tactical Rebalancing | $90,484.50 | $90,781.32 |

| Dividends | $10,755.94 | $35,195.90 |

| Ancillary Transactions | -$603.44 | -$54,340.55 |

| END OF PERIOD | $310,002.05 | $600,519.87 |

1 Net Change in Portfolio is the difference between the ending account value and beginning account value after activity.

DAILY BALANCES

| Date | Amount | Date | Amount | Date | Amount | Date | Amount |

|---|---|---|---|---|---|---|---|

| 2023-12-30 | $310,123.00 | 2023-12-22 | $310,529.00 | 2023-12-14 | $310,760.00 | 2023-12-06 | $313,924.00 |

| 2023-12-29 | $310,290.00 | 2023-12-21 | $310,711.00 | 2023-12-13 | $314,107.00 | 2023-12-05 | $314,033.00 |

| 2023-12-28 | $310,072.00 | 2023-12-20 | $310,653.00 | 2023-12-12 | $314,130.00 | 2023-12-02 | $314,119.00 |

| 2023-12-27 | $310,195.00 | 2023-12-19 | $310,514.00 | 2023-12-09 | $314,058.00 | 2023-12-01 | $313,866.00 |

| 2023-12-26 | $310,248.00 | 2023-12-16 | $310,322.00 | 2023-12-08 | $313,902.00 | ||

| 2023-12-23 | $310,468.00 | 2023-12-15 | $310,486.00 | 2023-12-07 | $313,941.00 |

INVESTMENT ELECTIONS

BOND AMORTIZATION ELECTIONS

Use constant-yield calculations to reduce bond premiums:

YES NO

Leverage an accrual approach to recognize discount across bond categories:

Straight Constant

Integrate market discount into taxable earnings every year:

Include Defer

| Fund Name | Traded As | EOD Price | Daily Volume (avg) | YTD Price Change | Category | One Day Change |

|---|---|---|---|---|---|---|

| Vanguard Growth ETF | VUG | 414.19 | 1145739 | 0.339 | Equity | -0.0126 |

| Technology Select Sector SPDR Fund | XLK | 234.47 | 4015302 | 0.2265 | Equity | -0.0127 |

| iShares Core MSCI Emerging Markets ETF | IEMG | 52.31 | 9449047 | 0.0667 | Equity | -0.0082 |

| SPDR S&P 500 ETF Trust | SPY | 588.22 | 46003064 | 0.2534 | Equity | -0.0114 |

| Vanguard FTSE Developed Markets ETF | VEA | 47.81 | 10714970 | 0.0312 | Equity | -0.0062 |

| Vanguard Dividend Appreciation ETF | VIG | 195.8 | 965248 | 0.1697 | Equity | -0.0125 |

| Vanguard FTSE Emerging Markets ETF | VWO | 44.11 | 8214263 | 0.1076 | Equity | -0.0088 |

| Invesco QQQ Trust Series I | QQQ | 515.61 | 29009270 | 0.2665 | Equity | -0.0133 |

| iShares Core S&P Mid-Cap ETF | IJH | 62.17 | 7659450 | 0.1366 | Equity | -0.007 |

| iShares Russell 1000 Growth ETF | IWF | 405.2 | 1349642 | 0.3432 | Equity | -0.0119 |

| Vanguard Total International Stock ETF | VXUS | 59 | 3544059 | 0.052 | Equity | -0.0067 |

Holdings for period 7/1/2025 - 9/30/2025

GETTING IN TOUCH

Your Financial Consultant: Valerie Bayer

ID: w0I7XHHY1

3994 Front Street El Monte Indiana, 50121

Contact Information

Business: 6098883328

22/46